As the level of production increases, the opportunities to gain the benefits of economies of scale with affect unit costs. The direct or variable costs may change, depending upon the quantities involved. A new diagram/table may have to be have drawn, which is time-consuming. Sales RevenueSales revenue refers to the income generated by any business entity by selling its goods or providing its services during the normal course of its operations. It is reported annually, quarterly or monthly as the case may be in the business entity’s income statement/profit & loss account.

They might modify their pricing, affecting demand for your goods and forcing you to adjust your prices as well. If they expand swiftly and a raw resource that you both use becomes scarce, the price may rise. A break-even analysis may also be a useful tool for determining precise sales goals for your team. When you have a precise quantity and a timeframe in mind, it’s typically easier to decide on revenue goals. Fixed costs are those that do not change regardless of how much of a product or service is sold. Fixed costs include facility rent or mortgage, equipment expenditures, salaries, capital interest, property taxes, and insurance premiums, to name a few.

Break-even analysis is useful in studying the relation between the variable cost, fixed cost and revenue. Generally, a company with low fixed costs will have a low break-even point of sale. It is a static model.Break-even Analysis as a static model is valid and accurate only for a very limited time period such as one year. And, each set of break-even calculations will only be valid for one point in time. Therefore, the analysis might not be very useful in a dynamic business environment as it represents only a snapshot position of the business. Costs change, market conditions change and prices change all the time.

Advantages of Break-even Analysis

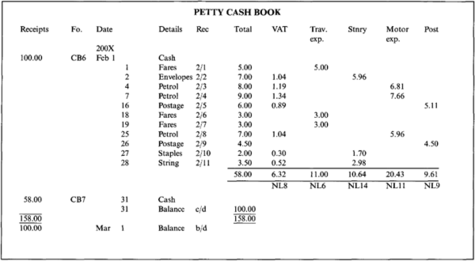

The calculation of break-even analysis may use two equations. In the first calculation, divide the total fixed costs by the unit contribution margin. In the example above, assume the value of the entire fixed costs is $20,000.

Plus, a manageable break-even point is likely to make you more comfortable with the prospect of taking on extra financing or debt. If you liked this article, we bet that you will love the Marketing91 Academy, which provides you free access to 10+ marketing courses and 100s of Case studies. When any of these things happen, the break-even point automatically increases due to the extra expenses that the company has to bear. Break-even analysis directs attention to the first of these.

Break-Even Analysis: How to Predict If Your Next Venture Will Be Profitable

Fixed costs include interest, taxes, salaries, rent, depreciation costs, labour costs, energy costs etc. The first and foremost limitation of the break-even analysis is that both cost and revenue should be taken into account to determine the break-even point. But this analysis assumes that prices do not change while in actual life, prices do change as a result of several factors, e.g., change in demand, fashion style, etc.

The break-even point is considered a measure of the margin of safety. A business can use break-even to consider the consequences of changes for a particular product. Break-even analysis is a beneficial management tool to aid the decision making process. It is also considered as a measure for the margin of safety. For 2018 were $133,045MM, which, when divided by 8,384,000, gives a price per unit of $15,869. For 2018 the number of vehicles sold worldwide is 8,384,000 units.

- If the managers suppose that one thousand units can solely be bought if price is lowered, break-even level ought to be re-calculated considering the change.

- Some company concepts are simply not intended to be followed.

- A break-even analysis may also be a useful tool for determining precise sales goals for your team.

- However, for firms with a large Product Portfolio, Indirect Costs must be divided between the various products.

In such a case, some monopolistic conditions prevail and high profits are earned over a large range of production activity. Low break even point and small angle of incidence show that fixed costs are low and margin of safety is high, but rate of profit is not high because of absence advantages and disadvantages of break even analysis of monopolistic conditions. High break even point and large angle of incidence show that fixed costs are high and margin of safety is low. A variation of the first method is that variable cost line is plotted first and then fixed cost line over the variable cost line.

It can also help you determine whether or not it’s worth producing a product at all. With this in mind, you can determine the lowest price for which you should sell your product to cover the production cost and make a profit. Break-even analysis tells you how many units of a product must be sold to cover the fixed and variable costs of production.

That’s the reason they frequently try to change the components of formula to reducing the number of units to produce and try to increase the profitability of the business. Break-even analysis refers to calculating and evaluating an entity’s margin of safety based on collected revenues and related costs. You can determine the best pricing for your products or services to make a profit or at least cover your total costs. This is the angle formed at the break even point at which the sales line cuts the total cost line.

Some Limitations of Break-even analysis

We also estimate that it will cost us $5 per widget to buy raw materials and prepare the widgets for sale . In the break even chart, we have seen that the total cost line and the sales line look straight lines. But, in practice, the total cost line and the sales line are not straight lines because the assumptions do not hold good. Thus, there might be several break even points at different levels of activity.

This gives the sales revenue.The contribution-to-sales ratio is given by dividing the contribution per unit by the selling price per unit. In some cases, the demand for a product as well as the customer sales remains constant, but there is an increase in variable costs. Break Even SalesBreak-Even Sales are sales where a company’s total revenue equals its total expenses, resulting in a zero profit. It is calculated by dividing the company’s total fixed expenses by the contribution margin percentage.

Accounting For Managers – Management Accounting-Cost Volume Profit Analysis

It is the production level during a manufacturing process or an accounting period where revenues generated and expenses incurred are the same, and the net income for that period is zero. Sales income and variable expenses do not grow in lockstep with the production value. They are less proportional than they should be at greater levels of output. This is due to trade discounts, bulk buying economies, concessions for bigger sales, and so on. It is assumed that variable costs are proportional to output volume. They move in correlation with production volume in practice, although not always in exact proportions.

Represent the above figures on a break-even chart and determine from the chart the breakeven point. To show the deviations of actual profit from anticipated profit relative profitability under conditions of high or low demand. Product specifications and methods of manufacturing and selling will not change. Using the diagrammatical methodology, break-even level can be determined by pinpointing the place the 2 linear traces intersect. High gasoline prices have worked to the company’s disadvantage. Garbage In, Garbage Out .The principle of Garbage In, Garbage Out means that if we use any incorrect or unrealistic data, we will receive unconvincing results.

Contribution Per UnitUnit Contribution Margin is the amount you get after removing the variable costs related to the sale of a unit from its total sales. It measures the contribution of a specific product to the Company’s overall profit. Break-even analysis is a very useful cost accounting technique.

The assumption behind break-even analysis is that all costs and spending can be clearly divided into fixed and variable components. In reality, however, a clear distinction between fixed and variable expenses may be difficult to make. To put it another way, it’s a financial formula that determines how many things or services a business should sell or offer to pay its costs .

Even in case your fastened costs, like an office lease, keep the same, you’ll have to work out the variable prices related to your new product and set prices before you start selling. This margin calculator will be your greatest pal if you wish to find out an merchandise’s income, assuming you realize its value and your required profit margin share. In the earlier instance, the break-even level was calculated in terms of number of units. This can be accomplished by dividing firm’s total mounted costs by contribution margin ratio.

Variable costs Variable costs are costs that will increase or decrease in direct relation to the production volume. These costs include cost of raw material, packaging cost, fuel and other costs that are directly related to the production. Break-even analysis is done by establishing a relationship between three significant elements of a project, i.e., costs, revenue and contribution margin. It can be an excellent tool to use when you’re starting up a new business, as it helps you to decide whether the idea is viable.

It should be used in conjunction with other quantitative and qualitative business tools and techniques, as well as in the context of a business. Only then the assumptions of the break-even model can aid comprehensive business decision-making. The breakeven point can predict the consequence of cost and efficiency changes on the profitability of a business. Dependent on certain assumptions, such as the price of goods remaining unchanged, whereas the fluctuation in cost is only considered. As such the break-even chart may not be proper indicator to cost analysis.

This is vital considering the many decisions made each day and all which come attached to a certain degree of risk. Some risks include setting a new price or deciding on a target market. As a result, it’s essential to be completely informed about all the risks involved before making any particular decision. As well as the variable cost while reviewing the financial commitment to figure out the breakeven point and in this way, some missing expenses which are caught out. It can be sound and useful only if the firm in question maintains a good accounting system.