When the limitations are news way too lower, this type of consumers would have to worry when they discover huge monitors. The FDIC site now offers advice to discover a lender account online otherwise during the a neighborhood department. Give the newest associate we would like to improve your direct put. Attempt to offer your head put navigation count and you will account count to change your advice over the telephone. Write to us what is actually altered about the family savings you utilize to possess direct put. Depending on the work with form of you may have to call us doing this.

News: What to do when the Mobile View Deposit Doesn’t Work

A trademark from the payee point at the top of the new straight back of the take a look at can be sufficient, but your lender might need a restrictive acceptance that renders their purpose obvious. We feel folks will be able to build economic choices that have rely on. In addition to submitting a photo, banking companies often ask you to input the new view amount. If this cannot match the number created to your look at — both numerals as well as the text message — the deposit will be refused. Deposit checks1 when you discovered her or him – skipping the newest visit to the brand new department otherwise Automatic teller machine. This may occurs if your smartphone features a failing Sites otherwise analysis relationship.

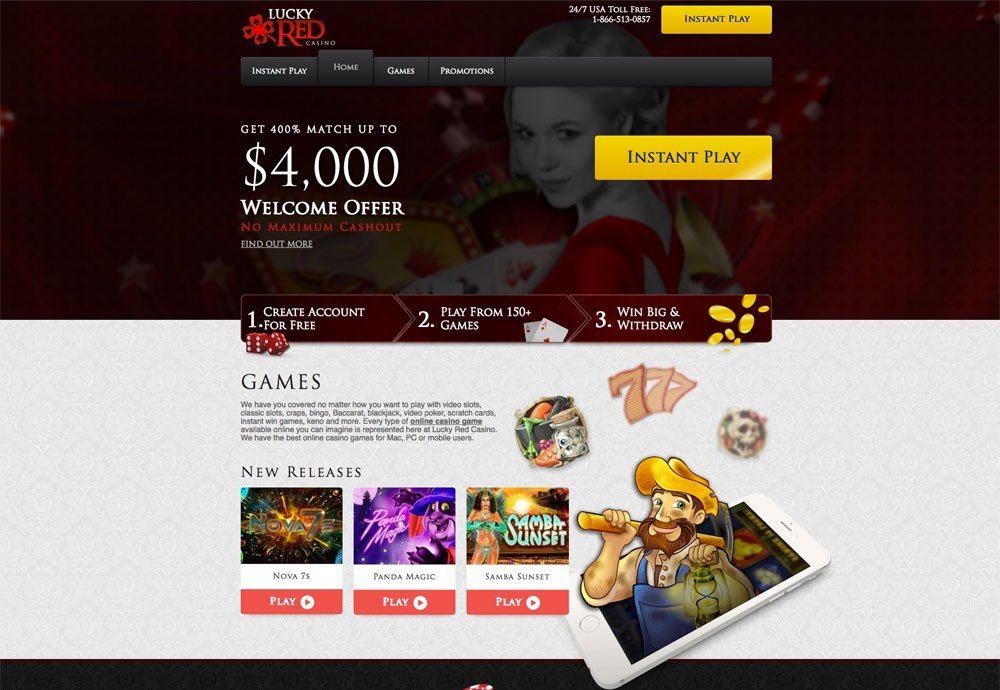

Bankrate features partnerships with issuers along with, however simply for, Western Express, Financial of America, Funding You to definitely, Pursue, Citi to see. Next, discover Pay By the Mobile method we would like to play with (then it Boku or Siru, such as). We are seriously interested in producing in charge playing and raising feel on the the newest you are able to dangers of gaming addiction. Playing will be amusement, so we desire one stop if this’s not fun anymore. Betting is going to be addicting, that will impression your life dramatically. Please search professional help for individuals who or somebody you know try proving condition betting signs.

And you will be unable to fool around with mobile take a look at put if your consider you need to deposit try above the restrict greeting from the financial. If you feel mobile look at deposit might possibly be a valuable financial ability, there are many things to consider when using it. The brand new Chase examining consumers delight in a great $300 bonus once you discover an excellent Chase Overall Examining membership making lead places totaling $500 or higher within 3 months away from discount enrollment. So it utilizes the brand new gambling enterprise’s plan, that may enforce a charge, and your mobile service provider may have prices for making use of your cell phone bill since the a payment approach. It’s far better prove the new gambling establishment’s conditions and terms as well as your mobile service provider to test if any extra costs may be obtain. It’s extremely secure to utilize the brand new Spend Because of the Mobile alternative as the enough time since you don’t lose the portable otherwise wear’t have to help you visitors.

You need a powerful cell phone code to suit your view visualize to travel to your own bank’s servers and now have affirmed. If the rule try weak, hold back until you have got a far greater laws before attempting to help you deposit their view, Meara states. Do not support the consider while you are photographing they; set it down therefore the photo is actually regular, not blurry. Just the take a look at is going to be regarding the body type — no stray documents, handmade cards, arbitrary Legos or any other visual interruptions. “Make sure your hands are not along the account number line at the the bottom,” states Bob Meara, Celent elderly analyst to have financial. Our very own couples never pay us to be sure positive reviews of the products or services.

Whenever usually deposited fund be around inside my account?

Bank Cellular App that makes use of the camera on your mobile phone to help you deposit checks in the You.S. Bank put profile. Monitors eligible for mobile look at put are user, business and you may business drafts, Payable As a result of drafts, money orders, cashier’s inspections and a lot more. A mobile consider deposit requires one or more complete working day in order to processes. If you would like your own money readily available quickly, particular loan providers tend to processes their look at quickly however, wanted your to invest a charge. So it percentage is usually a small percentage of the consider, as much as step 1% in order to 4%. Here, CNBC Come across reviews a number of the best banking companies offering mobile look at dumps and exactly how you could greatest make use of this ability.

U.S. Bank

Mobile view put might be a convenient means to fix deal with dumps to help you an examining, discounts or currency field membership. There are lots of banking companies and credit unions offering mobile consider deposit because the an alternative. Should your financial institution doesn’t provide it, you could consider starting a merchant account someplace else.

According to and that mobile phone you employ, you are questioned to check out you to definitely around three actions to help you be sure the fresh fees. You may have to get into your contact number, your own local casino ID, and code, but that is the suggestions that’s needed. The methods to have deposit a may differ slightly, with respect to the financial institution. For example, for individuals who put a good $dos,five hundred consider because of cellular deposits before six pm ET on the Friday, $225 of your own deposit will be on Friday.

Company costs

Checks becoming deposited digitally must also be endorsed just as they actually do whenever being deposited in person. Simultaneously, banks generally require you to generate a note such as “to own mobile deposit just” below your signature. The newest cutoff time for Mobile Consider Deposits are founded away from enough time area where account is actually open. Inspections obtained from the pursuing the cutoff minutes for the a business date are believed deposited thereon time, and will constantly be around next working day. To have mobile dumps, the bank could possibly get notify you that have a confirmation the view experienced.

Instead of after you deposit from the a department or Automatic teller machine, you’ll still have the new papers check in your own hands following the cellular put is created. GOBankingRates works closely with of a lot economic entrepreneurs so you can reveal items and you can services to the audience. These types of names compensate me to encourage items inside the ads across the site.

Easy access

You.S. Trust Business from Delaware are a wholly owned subsidiary from Bank out of The usa Business. From the TD Bank, there is always someone to keep in touch with about your membership. Their discounts federally insured so you can at the least $250,one hundred thousand and backed by a complete faith and you will borrowing of one’s You Authorities.

When you yourself have several bank accounts which have a loan company, you will be able to choose your appeal of a drop-down eating plan. If you want to put a traveler’s view or a out of a different financial, you will need to go to a local department otherwise Atm. Really creditors, except for online banking institutions, does not enable you to put these on the internet. Bankrate.com are a separate, advertising-offered blogger and you may analysis solution.

You could just be able to make standard dumps, which can be checks generated payable right to your, rather than the individuals paid back in order to someone else but closed off to you. In the event the a check is payable for your requirements as well as somebody else, there’s a chance you might still deposit it on the individual account—when the two of you promote it plus it’s perhaps not a large amount of currency. All of the account provides a good $50,000 aggregate restriction for each Business day.