Contents

Which method you choose will depend on your general trading approach. Remember in Chapter 4, the Bollinger Bandwidth can give an early indication of a pending move as volatility increases. This would be a good time to think about scaling out of online trade investment simulator signs you aren’t meant to be a programmer trading simulator new mt4 free position or getting out entirely. In the above example, you just buy when a stock tests the low end of its range and the lower band. Just like any other strategy, the Bollinger Squeeze shouldn’t be the be-all and end-all of your trading career.

The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Breakouts offer no clue on the direction and extent of future value movement. Consequent data points would drop the earliest price, add the price on day twenty-one and take the typical, and so on. The area that lies between the upper and the lower band is the Donchian channel.

Risk Warning

First of all, we need to choose a currency pair with a strong bullish or bearish trend. In this example (Fig. 1) is used a widget for forex patterns recognition called JForex. Select a currency pair with a defined trend on the daily chart. The combination of candlestick patterns and BB helps more clearly see the picture and determine the point of entry into the market. When using the default BB settings it is much easier to use. This approach refers primarily to the exchange of major currency pairs, but can be extended to other commodities.

This might sound strange but it’s possible to trade when there is a flat market and successfully too. This is the strategy referred to as Bolly Bound Bounce and is known to put up the Bollinger Bands indicator which is well known. You don’t require any other indicator except the Bollinger bands when applying this strategy. It’s best to understand what a retracement is before proceeding. A retracement is a price movement that defies the current trend but only short term.

How to earn $50 per day in India using this strategy?

Past performance in the markets is not a reliable indicator of future performance. Bollinger Bands can be applied in all the financial markets including equities, forex, commodities, and futures. Bollinger Bands can be used in most time frames, from very short-term periods, to hourly, daily, weekly or monthly.

Its goal is to report when the trend is most likely to reverse. You’re getting ready to change your spot with the early tip-off. The middle candle is the lowest for a bullish fractal and this forms a trough since it is flanked by two larger low points. To validate the presence of a reversal, you can use the ‘Alligator predictor’ alongside fractals. As this high-intensity trading style allows you to continuously track the demand, your focus will be checked. It will be necessary to make fast choices, such as whether to close or keep a place open.

Bollinger bands 1 standard deviation each side day trading strategy gap

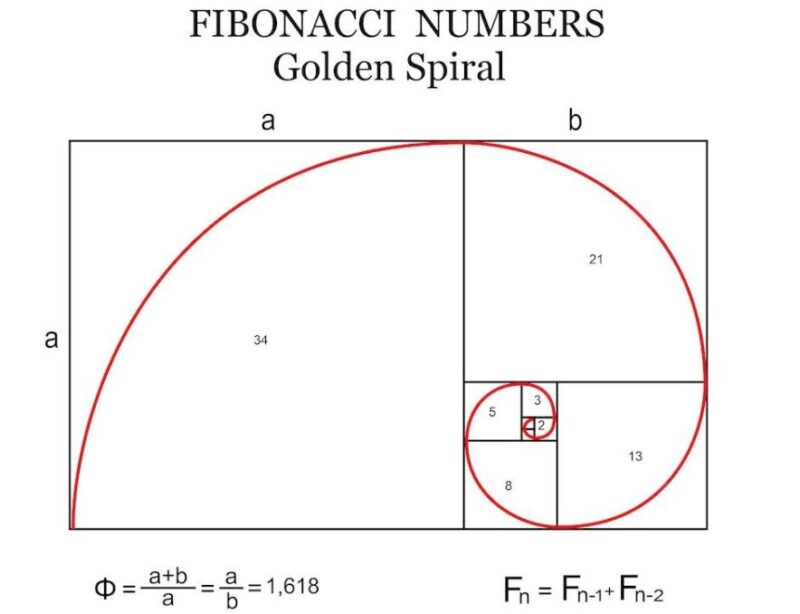

The highest indicator is provided by the Fibonacci, and the pivot point supports it. It prevents you from making emotional choices by getting well-laid How Much Does A Snapchat Geofilter Cost out laws that control when you reach and leave trades. Note, when trading is never a sure game, gut decisions carry the biggest loses.

- When the market is quiet, the bands’ contract, and when the market is crazy, the bands expand.

- The Drop ‘n’ Stop Exchange is the opposite of the trade of Pop ‘n’ Stop.

- Donchian channels are usually made of three different lines that have been formed by calculations pertaining to moving averages.

- The only time traders exit the trend is when there is a different event than expected.

In a demo environment, another bonus to trading is that you have access to past market trends. A technique can be implemented and you can see what the effect will be. Avoid trading if your indicators don’t show you an opportunity. On an average I won 8 trades out of 10 while following this strategy, thus giving a winning of 80%. You can see my live trades and the winning percentage in the image below.

Click for Old Stocks Analysis

The oscillator tool is displayed as a line graph that moves between two extremes . When RSI is combined with Bollinger Bands, traders can spot the buy and sell positions in the chart. Bollinger Bands are somewhat like moving average envelopes, but drawing calculations for both is different. In Bollinger Bands, standard deviation levels are considered to draw the upper and lower lines, whereas for Moving Average Envelopes, the lines are plotted by taking a fixed percentage.

There are multiple uses for Bollinger Bands, together with making use of them for overbought and oversold trade signals. Traders may add multiple bands, that help highlight the strength of price moves. Differently use oanda broker the bands is to appear for volatility contractions. The parabolic stop and reverse is a forex indicator used by forex traders to arrive at the direction of a trend, assess short term reversal points of a price.

Thus you are on a correct path of making money every day with single daily accurate tip. As long as you follow the indicator correctly, it works with a high success rate. This is one of the general Binary Options Strategy successfully used by traders in India. To use this strategy, you have to open a demo account with Olymp Trade, IQ Option, or Quotex.

The absolute value of the biggest of the three ranges is called the true range. However, the average true range is the moving average of specific true range values. In this book, you’ll learn what Bollinger bands are, how they work, and the correct way to use them.

Is Bollinger Band strategy profitable?

Are Bollinger Bands profitable? We conclude the Bollinger Bands are somewhat profitable in the stock market, which is a market that is very mean-revertive. We tested some ideas for Bollinger Band trading strategies, and it seems to work as a breakout indicator in gold.

You begin by defining three waves; an upward trend followed by a retracement and finally an upward trend appearance . The technique requires searching for a confluence or ‘coming together’ with the pivot support line between the Fibonacci retracement lines . For eg, during an uptrend, if you want to enter a long place, you can look for a confluence before entering the market. Waiting for a bullish affirmation candlestick is easier for a clear warning.

Inspired by Hurst, many others tried to construct similar trade bands but achieved little success. It was a simple moving average graph, showing highs and lows, plotted against a user-specified percentage. The modern Bollinger Bands are developed on the idea of Donchian Bands, which is a price envelope band showing the highest and lowest price differences for n number of days. However, Donchian Bands only taken into consideration recent highs and lows, which gives Bollinger Bands a clear advantage over it.

Are Bollinger bands useful?

It is one of the most useful indicators. This tool is useful to measure the volatility. As well as it identifies the overbought and oversold condition in the market. These bands are very popular among analysts, traders, and investors due to their effectiveness.

Look for the currency pair to hit or come very close to hitting the lower Bollinger. With this AFL you can find NR4 NR7 and Inside days with BB… Next, multiply that variance worth by 2, and each adds and deducts that amount from every purpose on the SMA. Update your mobile number & email Id with your stock broker/depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge. Bollinger Bands are a lagging indicator, so they do not predict the upcoming trends.